Senior Emily is in the mall debating whether to buy the cute sweater she has been eyeing. She is headed to college next year and is worried about her finances. If she cannot handle this small situation, how will she conserve her money in college? Questions start to cloud her head. How much will it cost to live? How much food will she have to buy? How will she afford books? These are all questions that students entering college should be asking.

Luckily for Emily, who asked that her name be changed because of the privacy of her financial situation, she has already begun to learn about how to handle her money and personal finances through the guidance of her parents.

“My parents add a set amount of money to my debit card once a week,” Emily said. “This way I will be able to control what I spend and not go overboard.”

Other CHS students are also starting to prepare themselves for the spending decisions they will have to make in the future. Senior Megan Le thinks seriously before making any purchase.

“I just try to keep in mind what is absolutely necessary before buying things,” Le said. “I try to buy clothing or shoes that are versatile so I can get the most out of my money.”

Le also keeps in mind the difference between cost and value when making a purchase.

“If an item is high quality but on the pricier side, I think it’s worth it,” Le said. “I try to stay away from products that are low quality with a ridiculous price.”

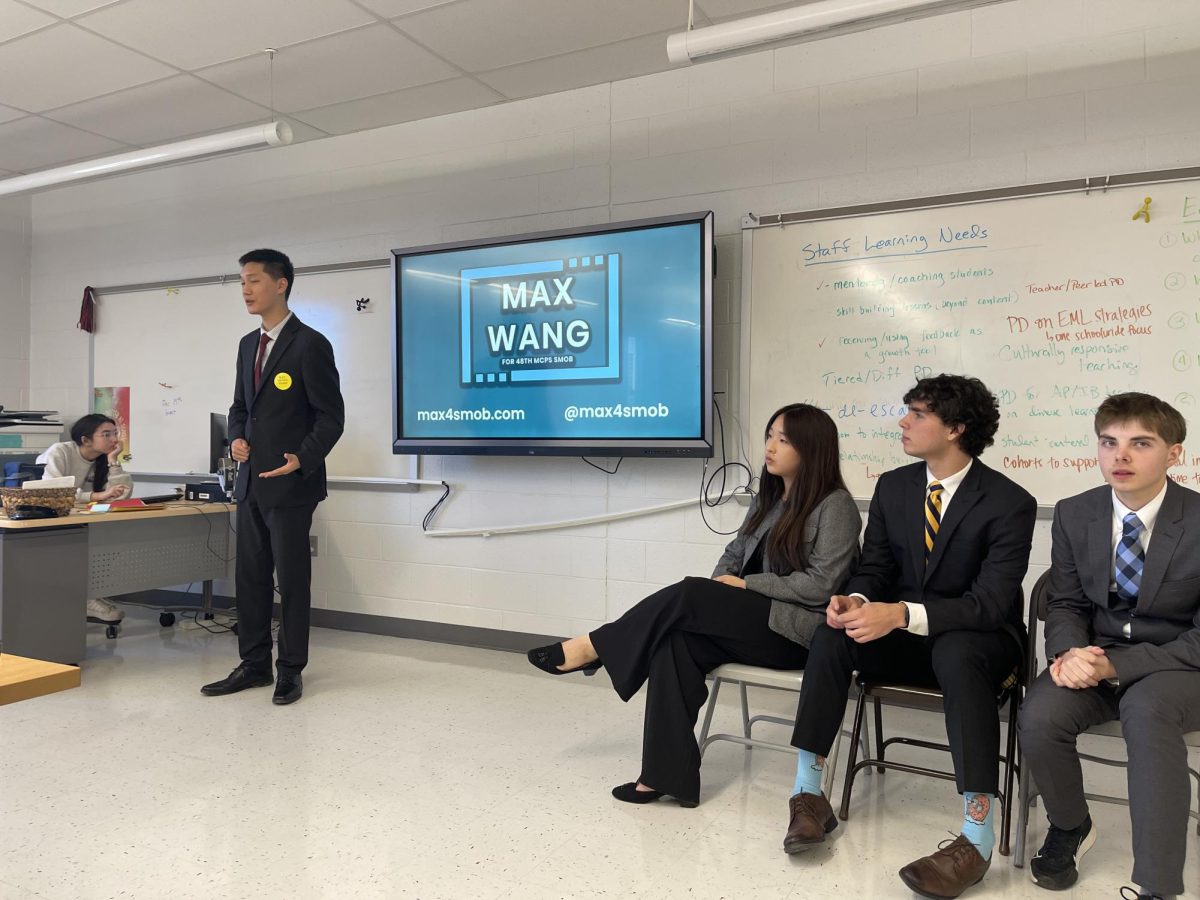

Not having enough money to pay your bills is everyone’s worst nightmare, and has been the reality of far too many due to the recent economic crisis. Students like senior Andrew Wang worry about interest rates and mortgages. Knowing how to handle and save money is vital to becoming an adult, yet few students are given the opportunity to know how.

According to CNN’s Money column, the state of Maryland received a “D” on personal finance education because it is not mandatory for schools to teach a course and when schools do, it is taught as an elective.

CHS Personal Finance teacher Kevin Doherty believes that the class is important because it teaches students how to handle their money once they are living on their own.

“It’s expertise you need every day for little things like buying food and maintaining a home,” Doherty said. “You need these skills no matter who you are, and you won’t learn them unless someone teaches you.”

According to Doherty, some college kids take personal finance courses. This may be helpful, but is also overdue. By the time kids reach college, they are already starting to live on their own and, if uneducated, are already acquiring money spending and saving habits that can remain with them throughout their life.

“When I go to college, I don’t plan to have a credit card,” Wang said. “That way, I can keep track of how much money I have, and I won’t receive any late fees or interest payments.”

Students whose parents do not teach them about finances are grateful for the opportunity that the class gives them.

“I learned all I know about personal finance from Mr. Doherty,” Emily said. “Like that I need to save money and buy stocks.”

Other students like Wang agree that the class teaches students how to ensure a safe financial future.

“When I begin getting credit cards and loans, I will check my credit report yearly so I can know if there is suspicious activity,” Wang said. “I know that if I apply for a debit card, I should check to see if it has overdraft fees, late fees, and bank fees.”

Besides the class offered at CHS, there are other programs offered in Maryland to help educate young students on person finance.

According to Doherty, Everest College, a system of career colleges located all over the United States and Ontario, has a program in which guest speakers go to different schools to teach students about personal finance. They have recently sent a representative to CHS to talk to the personal finance classes about controlling finances and Everest College itself.

Additionally, the University of Maryland hosts an annual Personal Finance Seminar during which the speakers discuss the most critical spending issues of today.

“I’ve learned quite a few things,” Wang said. “And we’re only halfway through the class.”