From August through November, WCHS seniors are on the grind. As college applications and extracurriculars replace downtime, the pressure remains to take challenging courses and maintain impressive grades.

As the college process can be highly overwhelming, the WCHS counseling department works to provide a sufficient amount of resources to help. Information sessions, emails and regularly available meetings with school counselors give students a sense of guidance and direction through their college processes. However, what about the financial side of applying to college?

Upon clicking through the WCHS counseling website, one can find in-depth details on getting teacher recommendations, submitting test scores and requesting transcripts, yet a scarce amount of information on scholarships and aid.

Other than information on the Free Application for Federal Student Aid (FAFSA), there are few to no resources on getting additional aid for college. The WCHS counseling department should play a larger role in assisting students with finding college finance opportunities.

Available starting in December 2023, the FAFSA form can be filled out by seniors and prospective college students to receive financial aid from the federal government. In addition, the College Scholarship Service (CSS) profile is another online application administered by the College Board for financial aid calculations, which is required only by certain colleges.

While FAFSA and CSS serve as the bases for assisting with paying for college, there are still downsides for many students. Many WCHS families fall under the upper to middle-class standing, where their possibilities for receiving financial aid are significantly limited. Not all students may receive merit-based aid, and FAFSA’s calculated “Expected Family Contribution” (EFC) may not consider all family expenses, meaning many WCHS students have needs for financial aid that FAFSA simply does not cover.

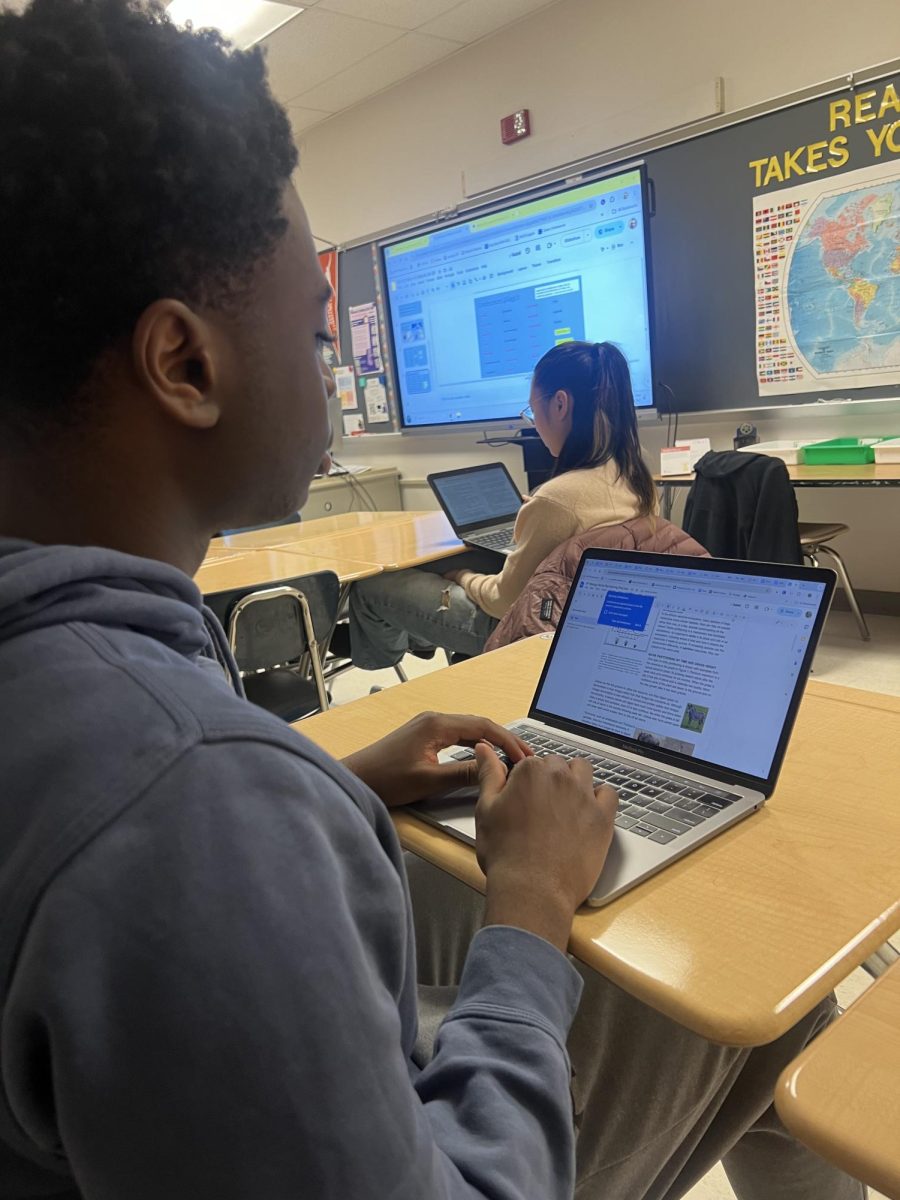

Due to this need for financial aid, students must look into seeking out scholarship opportunities. While students can be automatically considered for merit-based aid, seniors need to know about the numerous scholarship application opportunities available. To help students learn more about scholarships, WCHS needs to be doing more to educate them on how to navigate finding information on these resources.

Finding scholarships after applying to college can seem like hidden gems for WCHS seniors. Assistance with outsourcing scholarships should be a larger role for the counseling department.

Although several counselors and teachers, including WCHS College and Career Information Coordinator Raymond Doh, send out the occasional email announcing a scholarship application, many students do not check their emails or may not be eligible to apply. To avoid these inconveniences, a wider variety of scholarship applications and opportunities should be available to students. Students may not be aware of the abundance of private sector scholarships available, allowing families to save significantly while paying college tuition.

The counseling department could solve this issue by creating a database with applications to various scholarships with a wide range of eligibility for students: scholarships that fall under different categories of general, racial/ethnic, or religious eligibility. This way, students can easily access scholarship opportunities without going through the hassle of searching the internet and completing research that WCHS should be responsible for.

Another way the WCHS counseling department could assist students with scholarship opportunities and college finance is by including a more in-depth presentation on the topic during the several student/parent college presentations during the fall. These presentations should be doing a better job of reviewing the financial side of college after acceptance instead of primarily focusing on the application process.

While WCHS heavily prioritizes assisting seniors with their college application processes, the counseling department still has the potential to inform students on finding additional scholarship opportunities to cover their college tuition besides FAFSA, a crucial part of understanding college finance and avoiding unnecessary student debt in the future.