Show me the money: Is Personal Finance essential?

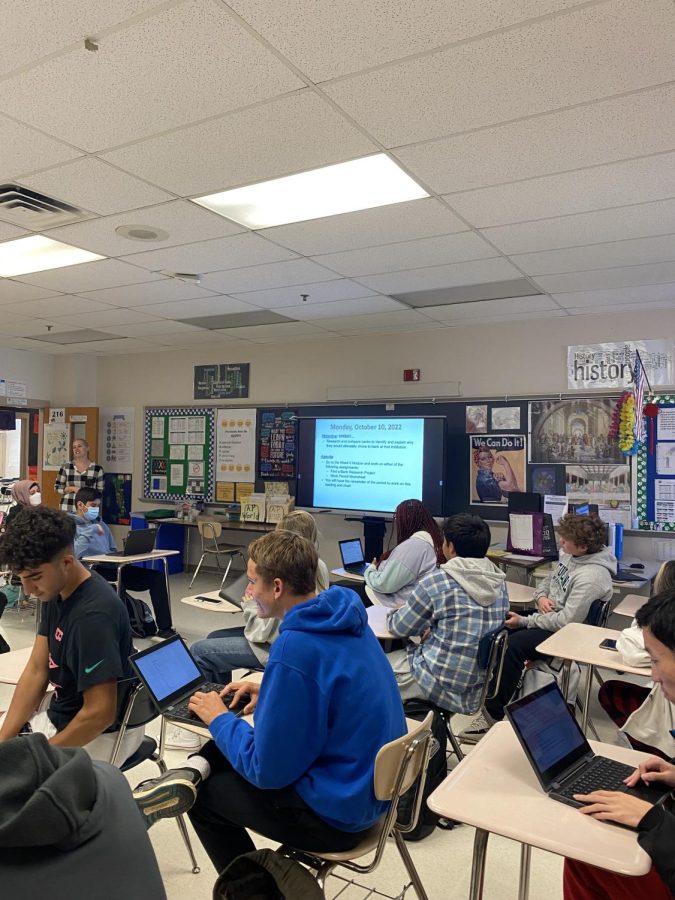

Personal finance, taught by Mrs. Brown, is a social studies class in which students learn about financial literacy.

October 20, 2022

Personal finance is a vital part of understanding and managing financial needs. After high school, students enter adulthood and are put to the test of living on their own finances. Thus, knowing how to invest, save money, do taxes and find a place to live are very beneficial skills for students to have.

The MCPS graduation requirements consist of 22 course credits and 75 SSL hours. The courses required are english, fine arts, health education, mathematics, physical education, science, social studies, technology education and electives. It is very manageable to take personal finance along with the other courses required.

Recently, The Maryland State Board of Education changed the graduation requirement for health education. Before, students were only required to take a half-semester of the class, but now students are required to earn one full credit of health education. This change only affects students from the Class of 2025 and younger. If this requirement is able to be changed, then personal finance’s requirement status should be as well.

In June, the Montgomery County School Board decided that “now is not the time” to require students to take personal finance. The Student Member of the Board, Hana O’Looney, proposed the idea to require all high school students to take a half-credit financial literacy course. The idea was rejected in a five to three vote. Instead of requiring the course, the school board approved a plan to require expanded access to optional courses on financial literacy.

Personal finance falls under the social studies category for MCPS courses. MCPS requires World History, Government and U.S. History. This allows students to put personal finance in their schedule for one year while doing the other three courses in separate years.

The MCPS course bulletin describes this class as “designed to help students identify and learn personal strategies for managing financial resources. Investment simulations are used to focus on the importance of managing funds and investing wisely. Topics include consumerism, personal finance, credit, and investment planning.”

According to the Financial Industry Regulatory Authority Foundation, students who are required to take personal finance courses have better average credit scores and lower debt delinquency rates as young adults.

Personal finance gives students a helping hand on how to be financially stable and prepared with their money. The course teaches students basic financial aspects that will be needed in their daily lives as adults. For example, credit-cards, debit-cards, credit scores, investing, saving and buying a house are all topics learned in personal finance. Financial education is one of the most relevant and applicable classes to students.

Some may argue that personal finance should not be a requirement to graduate because of the accessibility to knowledge on finances on the internet. Much like other topics, personal finance is able to be learned through YouTube, articles, online courses and more. In addition, personal finance being a requirement can add stress and decrease the flexibility that students have with their course selection.

Although the idea was rejected, not all hope is lost. Students can create petitions for the Board of Education to help raise awareness for personal finance. Students at WCHS can also create clubs that inform students about personal finance. Lastly, people can reach out to the Board of Education through their email: [email protected].